National Pension System

National Pension System (NPS) is a pension scheme launched by Government of India to provide old age security to Citizens of India, regulated by Pension Fund Regulatory and Development Authority(PFRDA).

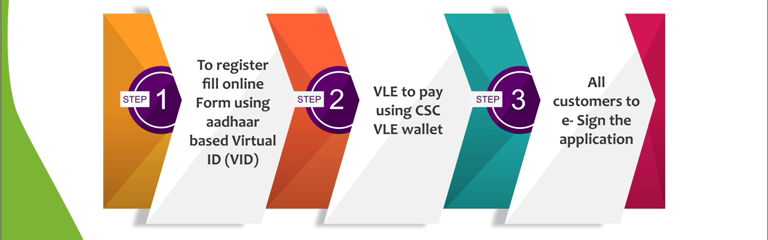

3 Steps to Register Online:

1.To Register fill online form using aadhaar based virtual ID (VID)

2.VLE to pay using VLE CSC Wallet

3.All customers to e-sign the application

Subscribers will be given the option to e-sign the form which eliminates the requirement to send the physical form

Benefits of NPS:

- lnvestments in NPS Tier I account qualify for tax deductions of up to Rs 1.5 lakh under Section 80CC(1). NPS also qualifies for an exclusive tax deduction of Rs 50.000 under Section 80CCD(1B).

- You get 10%-14% interest rate on your contribution which is more than FD ( Fixed Deposit) or RD (Recurring deposit).

- You can partially withdraw 25% of total amount after 3 years.

Commission Structure for VLE

- On Each For New NPS Account Opening :- Rs.167 (Instant Commission)

- On Each For Subsequent Contribution : – Rs. 16 (Instant Commission)

NPS can be Opened with a Minimum Balance of Rs.500